The Rich Dad Difference

Below are some notes on my study of the Rich Dad company teachings. These are notes from some of their free video on their website. Anyone can sign up for the free lessons.

By Robert Kiyosaki – Rich Dad, Poor Dad

3 Types of Education

- Academic

- Professional

- Financial

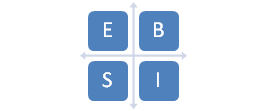

Cashflow Quadrant

Describes

4 types of people in the world is business and each are taxed differently.

- E – Employee

- S – Self-Employed, Small business, or Specialist (Doctors, Lawyers, etc).

- B – Big Business (500+ employees)

- I – Investor

Savers are Losers!

- 1971 Nixon took the dollar off the gold standard and made the US dollar the reserve currency of the world. Leads to economic volatility.

- Learn to invest your money and not save it.

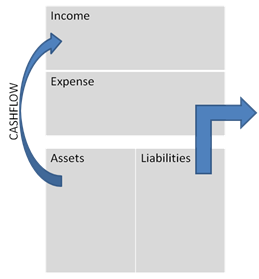

Assets vs. Liabilities

- One of the reasons people struggle financially is that they mistakenly call their Liabilities Assets. “Your house is not an asset.”

-

Learn to understand financial statements: Income Statements and Balance Sheets.

- Assets create CASHFLOW into your pockets.

- Liabilities take money from your pocket.

- Your house requires money to live in the house: rent, insurance, taxes, maintenance, etc.

- This doesn’t mean you should not buy a house, only that you need to understand the difference between and asset and a liability.

In my experience the Rich Dad series of books are very informative and useful in developing your financial education. For more information check out:

The diagrams above are probably copyrighted, but I am just using this post as notes on my own learning. I’m not selling anything anyway. J